The Potential Perils of AI: Insights from Yoshua Bengio

The technology could become more intelligent than people and eventually take over, according to Yoshua Bengio

Loading...

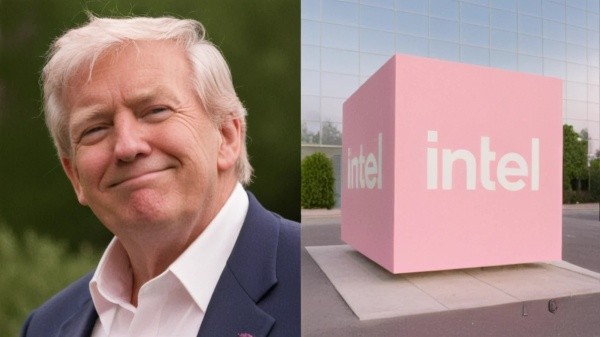

In a surprising move, former President Donald Trump revealed that the United States government will acquire a 10 percent stake in struggling chipmaker Intel, marking a significant government intervention in the corporate sector. This unprecedented step follows a series of developments including a tense meeting between Trump and Intel’s CEO Lip-Bu Tan.

Table of contents [Show]

The US government agreed to purchase approximately 433.3 million shares of Intel for $8.9 billion, at a price of $20.47 per share. This price represents a discount of roughly $4 compared to Intel’s closing share price of $24.80 on the previous Friday. Funding for the purchase will come from $5.7 billion in unpaid CHIPS Act grants and an additional $3.2 billion awarded to Intel for its Secure Enclave program.Intel’s stock saw a modest decline of 1.2 percent in after-hours trading following the announcement. Commerce Secretary Howard Lutnick confirmed on social media that the deal had been finalized, emphasizing that the arrangement is “fair to Intel and fair to the American people.”

The acquisition announcement follows a high-profile meeting earlier in August between Trump and Lip-Bu Tan, who became Intel's CEO in March. The meeting was initially spurred by Trump’s demand for Tan’s resignation due to his alleged ties with Chinese firms. However, the talks concluded with Tan agreeing to the equity deal, which Trump described as a $10 billion gain for the United States.This deal coincides with previous government efforts to support the semiconductor industry, including Intel’s receipt of CHIPS Act grants aimed at boosting domestic chip manufacturing and reducing reliance on Asia.

The government’s equity stake signals a shift in US policy towards more direct involvement in the semiconductor industry. This follows a recent $2 billion capital injection by Japan’s SoftBank Group, which was seen as a vote of confidence in Intel’s turnaround strategy.Analysts believe federal backing could provide Intel with additional resources to revive its struggling foundry business, which has faced challenges including a weak product pipeline and difficulty attracting customers to its new manufacturing plants.

Trump’s intervention reflects a broader national security strategy that includes fostering government partnerships in critical sectors like semiconductors and rare earth minerals. However, critics warn that such government involvement may introduce new risks and uncertainties for corporations.Trump has also advocated for deals with major companies such as Nvidia and rare-earth producer MP Materials to secure important supply chains.

The equity purchase has drawn some political support. Senator Bernie Sanders voiced approval of the plan, aligning with earlier calls by Senators Sanders and Elizabeth Warren for the Treasury Department to obtain warrants, equity stakes, or senior debt instruments from companies receiving government subsidies.Intel’s financial struggles have been significant, with a reported loss of $18.8 billion in 2024 — its first annual loss since 1986. The company last reported positive adjusted free cash flow in 2021. The government’s stake acquisition could be a pivotal step in Intel’s efforts to regain profitability and technological leadership.

The US government will acquire a 10 percent stake in Intel for $8.9 billion, funded by CHIPS Act grants and other programs, following a deal brokered after a meeting between CEO Lip-Bu Tan and former President Trump. This bold move represents a strategic intervention aimed at revitalizing the domestic semiconductor industry amid Intel’s ongoing financial and operational challenges.

Editor

The technology could become more intelligent than people and eventually take over, according to Yoshua Bengio

Countries should not compete through space programs, as this will only hurt humanity, astronaut Rakesh Sharma believes

It will be the first-ever spacewalk on a private mission. But does the US bear no responsibility for SpaceX’s soaring ambitions?